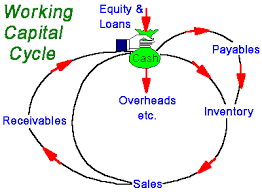

The first area, namely financial accounting, is primarily useful for ascertaining the results of the business on a periodical basis; for example, one year. This will help to determine the future course of action in the long term. In economical terms, financial accounting treats money as a factor of production.

Cost and management accounting are tools to enable management to take decisions on a day-to-day basis. Cost and management accounting are not useful for their own sake. These two functions assist management in the conduct of the business along with other key factors involved in running of the business. Key factors could be demand, supply, competition, availability of raw material, logistics etc.